Budgeting. A conversation topic only slightly more exciting than a conversation about your nephew’s fifth grade graduation ceremony. But sadly, unlike your nephew’s fifth grade graduation ceremony, budgeting should be a much more necessary part of your life. However, few people tend to make budgeting a regular part of adulting. In fact, according to Rutgers University, less than half of adults in the US budget regularly.

Nearly everyone knows that they need to budget, but so few people actually make one because they are unsure of how to get started. There are several different ways to budget from different budgeting apps, a spreadsheet, or even an old fashioned notebook. This post will show you how to put together a monthly budget long-hand and understand what is being done in the background of any budgeting app in only six steps.

STEP 1: Figure out what you spent last month.

Figuring out where your money went is imperative for you to know that way you can figure out where it is going and get ahead of your money. Go to your online banking or go get your most recent bank statement (but seriously, who still gets bank statements in the mail?). Open an Excel file or grab a notebook and start writing down where you spent money last month. Go through the items in each category together as best as you can. For example, if you went to Olive Garden on Nov. 1st, McDonalds on Nov. 4th, and Buffalo Wild Wings on Nov. 16th, add each of the totals together in the category of “Eating Out”. If you went to Walmart 15 times last month (like I usually do) then aggregate those amounts to “Groceries” or just “Walmart”.

Do this for each item for the previous full month that you have in your online banking or paper bank statement (but seriously, does it come in the actual mail?).

This will show you where you spend your money. And until it is written down, you probably have no idea where your money goes and you’ll probably be really surprised as to how much you actually spend.

Congrats! Now that you are probably thinking, “Holy crap, I eat out waaaay too much!” or “I should just get a part time job at Walmart since I’m there all the time anyway.”, you have completed the first step to your new financial journey and you are ready to move on to Step 2.

STEP 2: Assess where you spend your money.

This is really important in the budgeting process. And this part shouldn’t be too hard. Just take different places that you spend money and put them into categories. The categories should look something like this:

- Housing

- Food

- Utilities

- Transportation

- Savings

- Debt payments

- Fun

- Misc.

Each of these categories can (and probably will) be broken down into subcategories. For example, debt payments will probably have the different credit cards, student loans, car loans, etc. that you have. The food category will probably also include cleaning products and toiletries. Transportation could include tolls, car insurance, repairs, etc. But DO NOT include car payments, put those in the debt category.

At this point, you’ve probably been at this for a while. But know this, if you have come this far, then you have surpassed more than 90% of others out there. Most people have NO IDEA where their money goes. If this seems overwhelming, don’t sweat it too much. It’s overwhelming for all of us when we first try to get control of our finances.

STEP 3: Decide what areas of spending to cut or increase.

This is probably the most painful step in the process because you have to confront yourself. Where do you spend money that you probably don’t need to? If your electric bill is $300, don’t beat yourself up because you think it should be $275. There are other areas that you can cut back a lot more. If you are like most people, that area is eating out, According to the US Bureau of Labor Statistics, Americans spend nearly as much on eating out at restaurants as they do on food to be eaten at home!

Another area of overspending is that of social events. Remember, you don’t always HAVE to go to the party, the bar, or your nephew’s birthday party. And If you do go to those events, you can spend less than you normally would. Have two drinks instead of three (unless it’s at your nephew’s birthday party, then have four drinks instead of three). I’m not saying that you can’t go out and see friends and family, just plan for it and know what you are going to spend before you go.

The last big area that you should check for overspending is technology. Do you have the unlimited data plan for your phone but hardly ever use it? What about paying for a TV streaming service that you hardly watch? Do you have cable? (Seriously, the people reading this who have cable also probably get their bank statements in the mail.) Do you pay for an app on your phone every month that you haven’t used in a year? Do you have a gym membership but have to use your GPS to find the gym because you haven’t been there in so long?

You would be surprised at how much those items will add up? I’ve met with people who save over $150/month just by cutting out the little $4.99, $12.99, and $2.99 per month bills that they don’t use anyway!

STEP 4: Devise a plan to get one month ahead on all expenses in your checking account.

Completing this step is not necessary to win with your money but I PROMISE, it will make your life so much less complicated. Get to a point where all the money that you make in one month goes to pay the bills and expenses in the next. I’m not talking about putting a bunch of money in your savings account, just keep it in your checking account. I’m saying that if you can just get a little bit ahead, you will feel so much more at peace with your money.

It looks something like this: When the first of the month rolls around and you know that you have budgeted $3,000 (for example) for all of your bills and expenses for that month, you should ALREADY have that money in your checking account. This means that if you get paid on April 5th and 19th, you do NOT spend that money until at least May 1st.

Your checking account will look awesome and fat when you are almost at the end of the month because you have built up almost enough money to pay for the entire next month’s bills. As you pay your bills throughout the month your account will go down, but of course when you get paid, it will go back up. You will always have at least a few hundred dollars in your checking account. This will help you feel so much more accomplished and at ease with paying your bills because no matter what, you have enough to get through the next 30 days.

The obvious problem is that not many people have enough money in their checking account to pay all of their expenses for the next month. So how do you get to that point? You have to either save a little bit every month (which is what I did), sell something, earn some extra money through overtime or a side hustle, or use a bonus or tax return. Work your way to getting to this point and your financial life will become much less stressful.

STEP 5: Actually write it down.

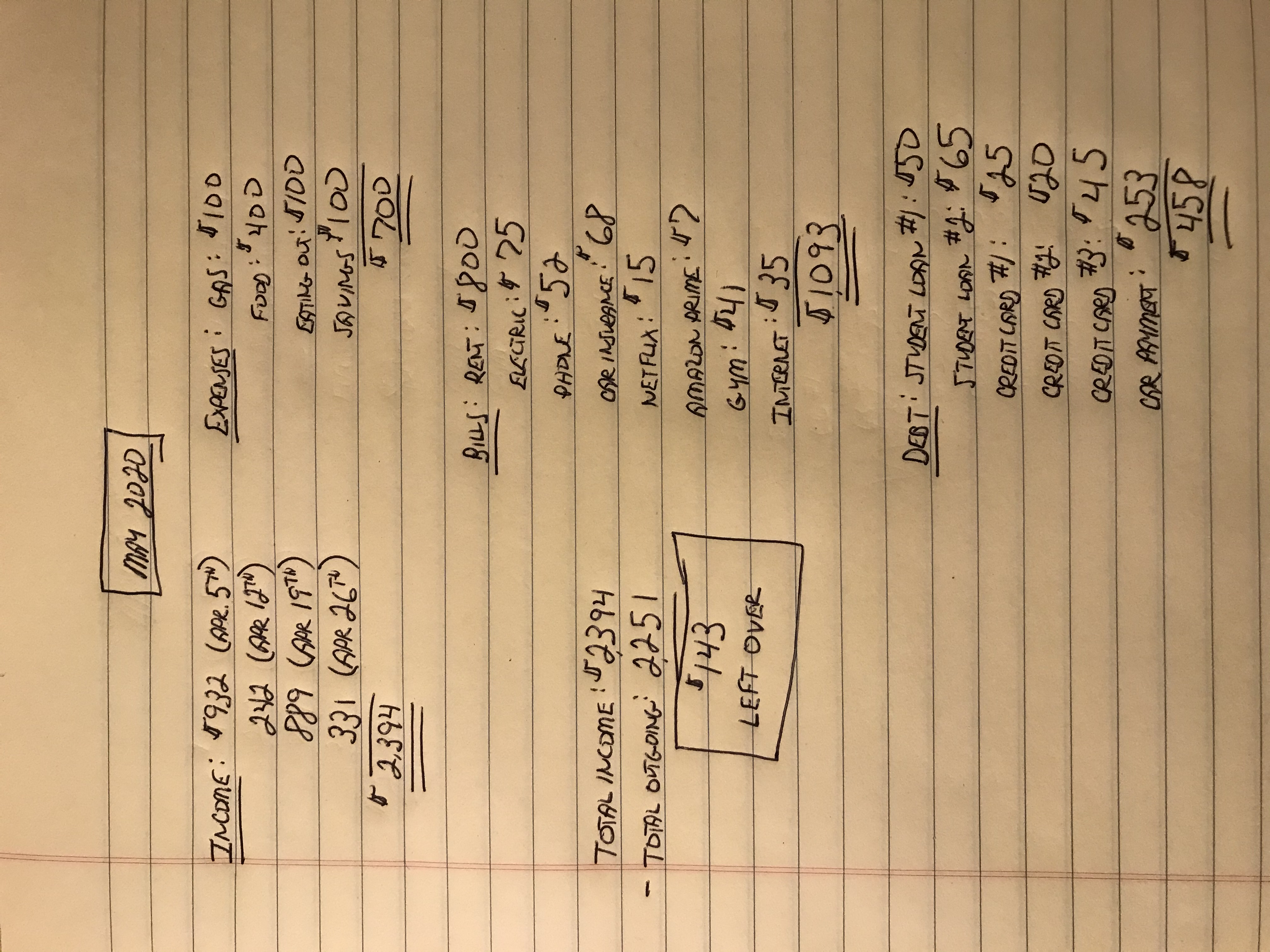

This is really important. You can’t just have your budget in your head. We all spend way too much money and have way too many transactions in a month to possibly remember all of them. And even if you remember MOST of them, your budget compared to what you actually spend will be way off. You can use an app, your bank may have a program, or you can simply write it down on paper. If you decide to write it down on paper or an Excel file it should look something like this:

This is the exact budget template that we used when we first started budgeting. If you decide to write yours out on paper, it will of course look a little different and have different amounts in it, but you get the general concept. If you decide to use a budget app, that is completely fine. Just know that the app is basically doing what I wrote out on paper in the background.

STEP 6: Do it every month and track your progress.

This must happen at the end of EVERY MONTH! You must have a plan of what to do with your money, or you will wonder where your money went! You will notice that in the budget example in Step 5, that there was $143 left over. That is money that can be put toward savings, spending, or (my favorite) paying off your debt. The important thing is that you have completed a budget. You have now moved a giant step in the right direction of taking control of your finances! Woot woot!

Remember, budgeting is as necessary to building your Money Muscle as having a workout plan is to your actual muscles. No one gets washboard abs and chiseled pecs without a plan. Likewise, no one gets (and keeps) a fat bank account without a regular budget.

Hopefully this has been helpful in starting your financial journey. Or maybe you just need a little tune-up. Either way, check out the rest of my content and start becoming more fiscally fit.

0 Comments