Equity indexed annuities. Annuities in general are one a really divisive financial topic and equity indexed annuities certainly fall into that camp as well. But before you put money into one, make sure that you understand the ins and outs of them. And most importantly, make SURE you know the hooks that come along with them (because there are some really big hooks). Let’s go over the pros and cons of equity indexed annuities and how they work so you can decide if they are right for you or not.

What Are Equity Indexed Annuities?

Equity indexed annuities (EIA) is a tax-deferred insurance product that is a blend of a fixed annuity and a variable annuity. An EIA is tied to a major market index. (The S&P 500 is the most common one.) They are treated like a retirement account as well. You have to wait until you are 59 ½ to access the money that you put into it or pay a 10% penalty if you access the money early.

An EIA gives you a stream of payments (usually for the duration of your life) that vary in amount of return but have a minimum rate of return (usually 0%) and a maximum rate of return (average of about 7%).

Think of a ratchet strap. A ratchet strap can only go one way. You ratchet it tighter and tighter but it won’t loosen. An EIA is the same way. The amount that you put into an EIA can only go up and not go down (because of the floor).

Sounds good, right?

Not so fast.

Insurance companies don’t just give away free money. No one knows when the stock market is going to go up or down. An insurance company or investor can’t just ONLY make money and NEVER lose money. So how can they offer this product to us?

Well there are some hooks.

Now that you know what an equity indexed annuity is, let’s go over the pros and cons of them so that you have a more clear understanding of what you would be getting yourself into if you were to purchase one of these products.

(1) Pro #1: You Cannot Lose Money

Okay, so this is a little misleading. You CAN lose money with an EIA, but not in the traditional sense. If you follow the rules of an EIA and leave the money in the account long enough and pay all applicable fees, you will not lose money on an EIA.

Equity indexed annuities have a floor. This is what makes them so enticing to people who are looking to invest some money but are really afraid to lose it if the market goes down. Enter: equity indexed annuities.

Let’s say that you put $100,000 into an EIA and over the first year that you have it the market goes down the toilet and loses 15%. Ouch.

But don’t fear! Because you have an EIA, you have a floor of 0%. This means that the insurance company that you put your $100,000 into has to take the loss. Not you.

This fear of loss of money is the #1 reason people put money into EIAs.

But please don’t stop reading now. Although that sounds great, there are a few catches.

(2) Pro #2: Riders

There are a lot of rules and restrictions (we’ll get to them in a minute) to take into consideration with EIAs. But a way to get around them is with riders.

Riders are basically add-ons to an insurance product. Some common ones are

- Disability Riders: If you get disabled, you can take the money out early.

- Waiver of Premium: If you get disabled, the company will make the premium payments on your behalf.

- Accidental Death and Dismemberment: If you die of an accident, the death benefit will be doubled.

- Return of Premium Rider: If you make all of your premium payments and don’t use the policy, the insurance company will give you your premiums back.

And there are several more.

Because an equity indexed annuity is an insurance product, you have the ability to add on riders to the coverage if you so choose. But remember, THEY ARE NOT FREE. The more riders that you add on, the higher your payment will be and/or the lower your rate of return will be.

(3) Pro #3: First-Year Premium Bonuses

One of the neat things about an equity indexed annuity is that often, they offer a first-year premium bonus. The bonus amount usually range from 2%-10%.

For example, if you open an EIA with a 10% first-year premium bonus with $50,000, you will be given an additional $5,000 to put into the account.

Sounds good, right?

Not so fast again.

Although these bonuses can make it enticing, if you don’t leave the money in the EIA for a specified period of time and/or don’t pay the plan fees then the bonus will go away. And often the bonus is given to you over a period of time ranging from 3-15 years. Not all up front as you might have thought.

Now let’s get to the major drawbacks of EIAs.

(4) Con #1: Surrender Charges and Surrender Period

Surrender charges are largely considered the largest drawback of equity indexed annuities (or annuities in general).

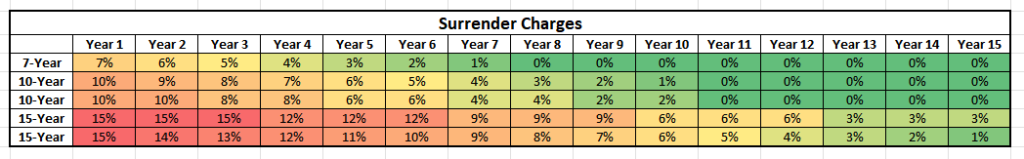

In order for an investment to make money, you have to leave it alone for a long period of time. Insurance companies know this. So they force people who have EIAs to keep their money invested with them. It is common for surrender charges to be 7-15 years.

That means that if you purchase an EIA, you will HAVE to leave it in the account for that period of time or else you will pay a STEEP penalty.

Oh yeah, you will ALSO have to pay taxes on any gains and an early withdrawal penalty of 10% if you are younger than 59 ½. Ouch. And ouch again.

Surrender changes are usually decreasing in amount over time. Here are some examples of how surrender charges for EIAs look:

This is a really big deal. Surrender charges can really come back to haunt you if you are not careful. They can really cost you a lot of money in the long run.

(5) Con #2: High Commissions

First of all, I believe there is nothing wrong with paying someone a commission. The last few cars that I have purchased, there were commissions paid to the salesmen/saleswomen. When I have sold or purchased a home, the realtor(s) have earned commissions. I have no problem with paying commissions when necessary.

But the commissions on equity indexed annuities (or annuities in general) can be ridiculous.

On average, an EIA commission is 6-8% of the deposited amount but can reach as high as 10%.

This means that the insurance salesmen would earn on average, $6,000-8,000 on a $100,000 EIA account.

However, that is generally the only commission that would be made by the insurance salesman.

In comparison, if you were to invest your same $100,000 into an ETF, the commission earned would be somewhere around 0.1%.

It is important to note that generally you will not have to pay that commission out of the money that you put into the EIA. The commission is generally paid by the insurance company.

A good rule of thumb is that the more complicated the product, the more expensive it will be and the higher the commission will be needed to sell it.

(6) Con #3: High Fund Expenses

Typically, an equity indexed annuity will charge around a 1% annual maintenance fee (also called an interest rate spread).

This means that if your EIA has a 5% gain in a given year, you will only get a gain of 4% because you have to pay the maintenance fee.

If you are considering working with a financial advisor, a 1% fee is pretty average. But if you are considering simply investing passively into a mutual fund, index fund, or ETF, a 1% fee is really high.

And remember, you will have to pay that EVERY YEAR.

(7) Con #4: Your Returns Are Capped

Mathematically, this is the #1 reason that you should avoid putting money into an equity indexed annuity: your returns will always be capped.

This means that you will NEVER make more than a stated percentage, even if the market does way better. On average, this amount is 7%.

So if the market has a good year and makes 12%, an EIA will only get 7%.

Insurance companies know that the market averages greater than 7% each year. That means that if they have to pay out a MAXIMUM of 7%, they will almost always make money.

This is the largest cost of an EIA. When the market does well, you don’t get to participate. You have to sit on the sidelines.

This is also the ying to the yang of the 0% floor. Yes, you won’t lose money. But you also won’t gain very much either. When the market is bad and makes a negative return, you win and the insurance company loses. But when the market does well and makes more than 7%, you lose and the insurance company wins.

(8) Con #5: Participation Rates

Another big drawback of equity indexed annuities is that they have participation rates. These rates usually average 80-90%.

This means that if you have an EIA with a 90% participation rate and the market goes up 10% in a given year, then your account would only go up 9%. Eeek.

In other words, you only get to participate in part of the gain.

It’s also important to note that the capped returns and participation rates are not exclusive of each other. They are almost always STACKED! That means that you will have a participation rate of 80-90% AND a maximum return cap of 7% on average. Holy cow that sucks!

(9) Misc. Drawbacks

There are some other drawbacks to EIAs as well. However we have covered the bulk of the main drawbacks already. Some of the other miscellaneous drawbacks that will only affect a small number of people are:

- They can be tricky to give to charity (unlike a regular equity investment).

- There is no loss deduction (like there is with a regular equity investment).

- You can still lose money if you take the EIA out before the surrender period is up.

- There is no stepped-up basis for tax purposes with annuities as there is with other equity investments.

- This means that your heirs will owe a lot more taxes on the EIA that they inherit from you as opposed to inheriting money, stocks, bonds, etc.

(10) Investment Comparison

Let’s put all of this together. Let’s compare two people: Jack and Dianne.

The year is 1990 and they both have $100,000 to invest that they will not need until 2020 (30 years).

Jack is okay with investing all of his money in the S&P 500 and riding the ups and downs of the market for the next 30 years.

But Dianne does not like the prospect of losing any money at all. She elects to put all of her money into an equity indexed annuity. Her EIA is perfectly average. She has:

- A 10 year surrender period.

- A floor rate of 0%.

- A cap rate of 7%.

- A 90% participation rate.

- For simplicity, we will ignore maintenance fees.

Here’s what both of their investments look like each year for 30 years:

Because Dianne took the road of “less risk” she made nearly $660,000 LESS than Jack!

Yes, Jack did have some losses along the way but he more than made up for them over time.

Another way to look at it is with this graph:

This graph shows the returns each year for both Jack and Dianne. As you can see, Dianne misses out on the drops in the market from the Dot Com recession and the Great Recession. But she doesn’t get to have the big gains of several of the other years.

Final Thoughts

As you can probably tell from this article, I am not a big fan of equity indexed annuities. Yes, they offer you the protection of a down market. But the cost is simply too high.

Remember, whenever you see an overly complex financial tool. It is not overly complex for your benefit. It is for the benefit of the company selling it.

Also remember, that if you ever want a guarantee, it will cost you. Nothing in life is guaranteed. And likewise, nothing in the financial world is guaranteed either. You will have to pay for it in the form of surrender charges, earnings caps, high commissions, and overall less earning potential.

I am here to help you avoid the pitfalls and traps of the financial world!

Please let me know how I can help you!

Until next time!

0 Comments