Risk is an EXTREMELY important topic when speaking about investing. After all, risk and reward go hand in hand. How do you measure each one? With reward, that is easy. It’s measured in how much money you made on your investment. But with risk, it is a little bit more difficult. That is why there is a financial term called “beta”. This is the measure of risk in an investment compared to the entire market. Let me explain.

Risk and Reward

Before we move on, it is imperative that you understand that there is a relationship between risk and reward.

If you are investing and you don’t want to take much risk (this is called being risk averse) that is okay. But just understand that your investments will have very little reward.

On the other hand, if you are okay with taking a lot of risk, you will have the potential for a very high reward.

It looks like this:

Low Risk = Low Reward

High Risk = Potential for High Reward

For a more detailed explanation on the balance between risk and reward, check out this article.

Beta: How Risk is Measured

There is a financial calculation that is used to determine the risk of an investment. This is called a beta.

In order to determine this it has to be benchmarked to something. That “something” is the whole stock market. Usually analysts use the S&P 500 for this.

So to figure out how much risk a particular investment has, it is in comparison to the S&P 500. An investment might have more risk than the S&P 500 or less risk than the S&P 500.

The S&P 500 has a beta (measure of risk) of 1.0.

If another investment has a beta of 1.0, that means that it has just as much risk as the S&P 500.

If an investment has a beta of 2.0, that means that it has twice as much risk as the S&P 500.

If an investment has a beta of 0.5, that means that it has half as much risk as the S&P 500.

You get the picture. 🙂

The nice thing about a beta of most stocks also, is that you don’t have to calculate it! Which is really nice because the calculation is a little difficult unless you understand statistics, covariances, and variances.

The really nice thing, also, is that you can just look these up. I usually use Yahoo! Finance.

Let’s look at a couple examples.

Let’s say that for each of these examples, you can expect the S&P 500 to increase by 8%.

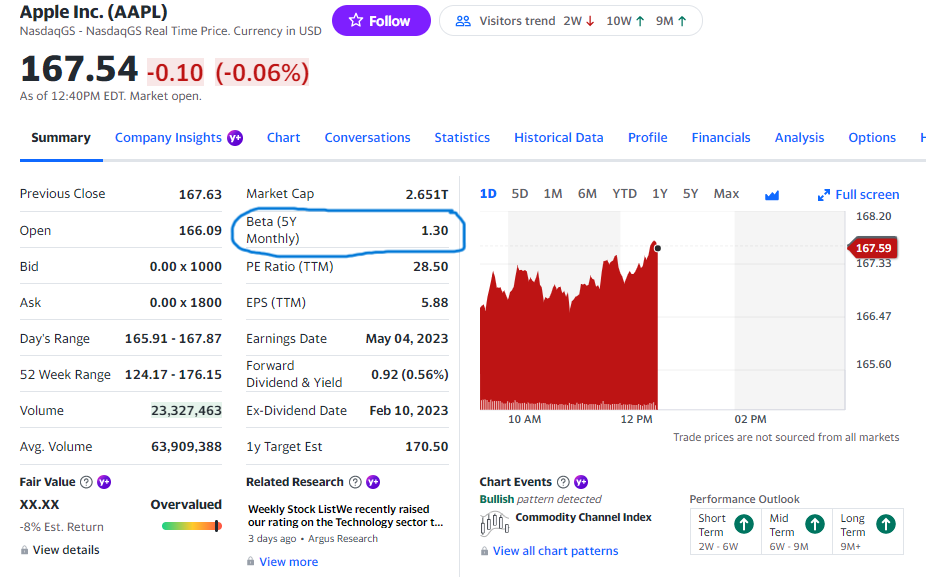

This is a screenshot from April 2023 of Apple on Yahoo! Finance. As you can see, Apple has a beta of 1.30. This means that an investment in Apple has 30% more risk than an investment in the S&P 500. This also means that you could likely expect a 30% higher return on your investment in Apple as compared to investing in the S&P 500.

So if the S&P 500 gains 8% in a year, you can expect an investment in Apple to gain 30% more. So an investment in Apple should go up 10.4%.

The calculation for this is 8% * 1.3 = 10.4%.

Let’s look at another example.

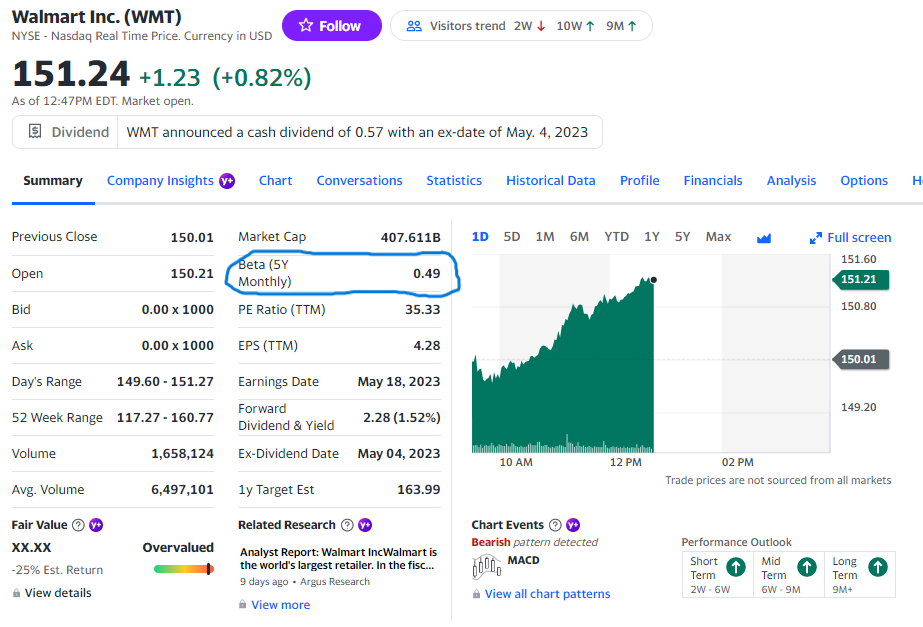

This is a screenshot from April 2023 of Walmart on Yahoo! Finance. As you can see, Walmart has a beta of 0.49. This means that an investment in Walmart has about half as much risk as an investment in the S&P 500. This also means that you could likely expect a 51% lower return on your investment in Walmart as compared to investing in the S&P 500.

So if the S&P 500 gains 8% in a year, you can expect an investment in Walmart to gain 49% of that. So an investment in Walmart should go up 3.92%.

The calculation for this is 8% * 0.49 = 3.92%.

Let’s look at one more example.

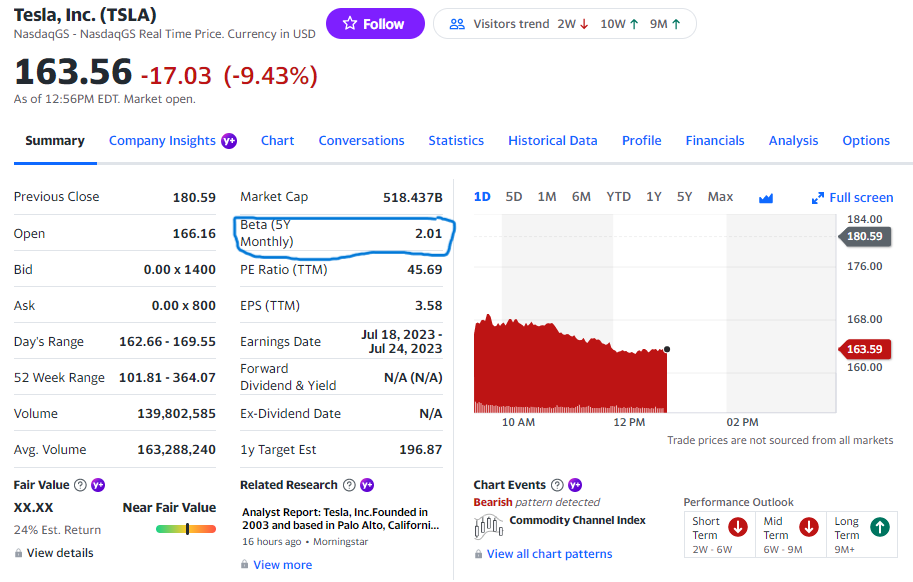

This is a screenshot from April 2023 of Tesla on Yahoo! Finance. As you can see, Tesla has a beta of 2.01. This means that an investment in Tesla has about twice as much risk as an investment in the S&P 500. This also means that you could likely expect a 101% higher return on your investment in Tesla as compared to investing in the S&P 500.

So if the S&P 500 gains 8% in a year, you can expect an investment in Tesla to gain 201% of that. So an investment in Tesla should go up 16.08%.

The calculation for this is 8% * 2.01 = 16.08%.

Caveat

It’s important to understand that even though you might know the beta for a particular stock, that does not mean that you are GUARANTEED that return on your investment.

The beta of a stock is simply the return that investors expect to get based on the level of risk for that particular company.

Just because Tesla has an expected return of 16.09% (in my previous example) does not necessarily mean that you WILL get that return. In theory you should. But not always.

Final Thoughts

A beta is one of the fundamental building blocks of investing. Even if you are only investing in mutual funds and ETFs, they also have betas. And based on the goals of the funds, they might have a beta of less than 1.0, exactly 1.0, or more than 1.0.

As always, make sure that you understand what you are investing in and why you are investing in that particular company or product. And also understand that there is a level of risk with investing. 🙂

You can do this!

Until next time!

0 Comments